The digital age, brimming with technological marvels, has invariably reshaped the landscape of many industries, with the banking sector at the forefront of this transformation.

In recent years, an escalating number of banks, complemented by various private corporations, have taken a decisive tilt towards demanding customers employ digital identification methods such as facial recognition and dedicated applications. These digitised gateways, hailed for their convenience and security, concurrently unfurl a tapestry of challenges, encompassing concerns from cybersecurity and legal ambiguities, to the foundational principles of privacy and civil liberties.

With the materialisation and distribution of digital technologies, corporations have placed a heavy reliance on digital technologies and director identifications with a potential for all currencies to be placed into the digital realm through the implementation of Central bank digital currencies (CBDCs).

Central bank digital currencies (CBDCs) are a form of digital currency issued by a country’s central bank. They are similar to cryptocurrencies, except that their value is fixed by the central bank and equivalent to the country’s fiat currency, but they are not backed by gold or silver.

In theory, these utopian models of currency may appear to be a matter of convenience and trackability, but that is the problem… These technologies threaten privacy as they tether private citizens to the Federal Reserve and a nation’s banking system. Unlike paper dollars, it would offer neither the privacy protections nor the finality that cash provides. But more importantly, these tethers can be breached by hackers or equally threatening, a person’s livelihood can be paused, ceased or confiscated if the State deems a person, company or group a threat.

Put simply, a CBDC would most likely be the single largest assault on financial privacy since the creation of the Bank Secrecy Act and the establishment of the third‐party doctrine.

The threat to freedom that a CBDC could pose is closely related to its threat to privacy. With so much data in hand, a CBDC would provide countless opportunities for the government to control citizens’ financial activity. However, this would not be achievable unless the government supported private organisations implementing policies that could identify and track a person with the precision of biometrics.

Central to the Australian context is the Privacy Act 1988, which explicitly underscores the imperative of safeguarding the privacy of individuals. It delineates stringent guidelines for the management and use of personal information, insisting on principles that prioritise fairness, lawfulness, and non-intrusiveness.

On a global pedestal, privacy frameworks like Europe’s General Data Protection Regulation (GDPR) emphasise the unequivocal rights of individuals over their personal data. This regulatory edifice demands stringent adherence, potentially complicating the foray of businesses into practices that might infringe upon these sanctified principles.

The philosophical sanctity of privacy is entrenched in democratic societies. Eminent philosophers, such as Judith Jarvis Thomson, argue that an individual’s right to privacy is fundamentally tethered to the right to autonomy and self-determination. Mandated digital identification, thus, opens up a Pandora’s box: Where is the limit to corporate demands, and when does it tread on the hallowed grounds of personal freedom?

Governments have long recognised that freezing someone’s financial resources is one of the most effective ways to lock them out of society. However, a CBDC tethered to a person’s digital identification could make the process easier and faster for governments by establishing a direct line between citizens and the government that has been shown to be enmeshed with private corporations who act as surrogates of social control as they do not have the public accountability that governments possess.

CBDC can enable governmental bodies and private industry participants to encode specific policy operations that adhere to the directives of the day.

By encoding a CBDC, funds can be accurately directed towards what individuals can possess and what [individuals can undertake]. Such actions cannot be possible without currency being tied to a person’s identity, thereby placing each in a precarious position of social control.

As we had seen in Australia during the July 24, 2021 protests against lockdowns, Australian companies acted in lockstep with the government taking punitive, paramilitary-style action against those people protesting the need for lockdowns. Some people attending this gathering were fired from their jobs, some jailed in inhumane conditions, some placed on leave, whilst others were fined for attending.

The ethereal realm of the internet is riddled with threats, both seen and unseen and with the emergence of the dark web, more sinister objectives can be achieved with the intended goal of subverting international jurisdictional limits.

Recent history is replete with incidents like the Panama Papers, which unveiled a treasure trove of personal and financial data, underscoring the vulnerabilities inherent to digitised data storage. For corporations stockpiling biometric and personal data, the weight of responsibility is titanic, but the implications on the right to privacy once breached may never be remedied because people cannot just change their facial features, fingerprints or identity features once stolen.

So, where is the balance if not maintained by the traditional methods of physical security? That’s right, if it’s not online, it can’t be stolen.

Hackers, ever-evolving in their craft, continually scout for potential vulnerabilities from countries where treaties may not exist, or tax havens where secret trusts can trade without the attention of authorities or regulators (often limited by jurisdictional borders). The jeopardy extends beyond just monetary repercussions; stolen facial recognition data or personal details can cascade into identity theft, financial deception, and myriad other cybercrimes. Indeed, the national security of an entire nation can be compromised thereby opening tax records and other personal information up to the world. Cyber-savvy committees and boards are engaging in increasingly frequent discussions concerning critical topics such as cyber risk appetite, cyber risk tolerance, cyber risk quantification, and the risk-based approach to cybersecurity.

As per Cybersecurity Ventures’ predictions, the global annual cost of cybercrime is on track to reach a staggering USD 8 trillion in 2023. This alarming trend is further exacerbated by the mounting cost of cybercrime-related damages, which are anticipated to soar to $10.5 trillion by 2025.

The data presented in the 2022 Official Cybercrime Report, a study sponsored by eSentire and conducted by Cybersecurity Ventures, underscores the persistent nature of cyber risk. Consequently, it is imperative that our high-level executive discussions pivot toward proactive strategies for enhancing cyber resilience and positioning our organisations to navigate the challenges of business disruption.

Against the backdrop of these potential digital transgressions, individuals find themselves pitted against colossal corporate entities, often with a David-versus-Goliath dynamic. Australia’s judicial architecture, notably, doesn’t equip plaintiffs with mechanisms akin to the US, where protective cost orders somewhat level the playing field.

Such discrepancies are not mere procedural nuances but instead signify a deeper chasm, where individuals, especially in countries like Australia, might feel bereft of robust channels for seeking justice against corporate behemoths because the system does not provide substantiative protections for the common person due to Court rules on Costs. As we had seen during Covid, the private organisations generally succeeded in a number of court and tribunal hearings after filing interlocutory application after interlocutory application to draw down the financial resources of their opponents and then threaten them with an adverse costs order. This is the reality of access to justice for the vulnerable in Australia. They must wear the costs, crowdfund or hope a law firm (usually small law firms) assist them in this endeavour.

This is a real restriction on access to justice that must be remedied, or Australia will become known as a protectorate of commercial organisations under the guise of blind justice. These are the rules, but they can change if Parliament provides avenues for public interest cases and those cases where hardworking mums and dads must hold the line to reserve their legal rights in a Court of law.

Historically, constitutional frameworks have served as the vanguard against undue intrusions into the private realm of citizens. While these statutes traditionally shield against state transgressions, their application in the face of corporate encroachments remains a murky terrain complicated by cross-jurisdictional boundaries and secret trading routes.

In Australia, the absence of explicit constitutional rights to privacy does render the landscape challenging. However, the implied freedoms might be the bedrock upon which arguments against excessive corporate intrusion could stand, but after Australian Courts confirmed Australia does not have to follow international Covenants such as the International Covenant on Civil and Political Rights, one does not hold out hope that anything can be achieved unless specific legislation is passed to protect citizens and provide robust legal and regulatory avenues that can be pursued in the case of breach.

A pivotal concern in this entire discourse is the eroding trust towards corporations, especially when it comes to managing personal information. A slew of incidents has reinforced a belief that corporations, when push comes to shove, prioritise profits over overarching social, ethical, moral, and even legal responsibilities.

This perception, whether wholly accurate or tinged with generalisations, has profound implications. For the digital transition to be genuinely seamless and widely accepted, the onus lies as much on the technological robustness as on the ethical integrity of these corporate entities, something that has been lacking, especially since the release of the Pandora papers saga. The Pandora Papers that seen the leak of almost 12 million documents has shed further light on the secretive, mysterious world of offshore companies and trusts.

These complicated and confidential structures were set up in so-called ‘tax havens’ or ‘secrecy jurisdictions’ where one’s information could theoretically circulate and may be used by many of the world’s wealthiest and most powerful people and corporations to shift and store money internationally, without anyone knowing. Is this a possibility, indeed it is, especially with the digital transactions where everything is done on the world wide web.

The entitlement to privacy is pivotal to the appreciation and execution of individual freedoms both in the virtual and physical realms. It anchors the very essence of a democratic community and is instrumental in actualising an array of human entitlements in the cybernetic domain, encompassing rights like free speech, freedom to congregate, and the entitlement to partake in socio-economic privileges. Any transgressions upon this entitlement to privacy may disproportionately afflict certain personas or collectives, thereby intensifying disparities and prejudice across middle and lower classes (especially). Do you really think there is convenience in disclosing what you wish to purchase, or provide a reason as to why you want to purchase something or why you wish to withdraw your own money?

Article 12 of the Global Proclamation of Human Freedoms and Article 17 of the International Covenant on Civil and Political Rights (ICCPR) stipulate that none shall encounter capricious or illicit infringements on their privacy, kinship, domicile, or communications, nor face unauthorised denigrations of their dignity or esteem.

These provisions further enunciate that ‘all individuals possess the entitlement to juridical defence against such invasions or affronts.’ Though the entitlement to privacy within the global rights framework is not unequivocal, any breach must be anchored in legality and undergo rigorous scrutiny of its indispensability and equivalence pursuant to Australian or domestic laws as they may be enunciated.

From 2013 onwards, the United Nations General Assembly along with the Human Rights Assembly have sanctioned several decrees concerning the entitlement to privacy in the cyber age.

The most contemporaneous decree regarding privacy rights in the digital era was ratified by the Human Rights Assembly in September 2019: A/HRC/RES/42/15.

Central to this decree, it reiterates that nations must ascertain that any breach of privacy aligns with tenets of lawfulness, indispensability, and proportionality. It reaffirms that the entitlements upheld in the tangible world should be mirrored in the digital realm, inclusive of the right to privacy. Furthermore, it recognises that the inception and evolution of avant-garde technologies, such as machine cognition, can influence the exercise of privacy entitlements and other personal freedoms.

The decree furnishes a gamut of suggestions to Member Nations and corporate entities, focusing on fostering reverence and safeguarding the entitlement to privacy in our digitally driven epoch that is moving ever so closer to the panopticon.

The trajectory towards an increasingly digital world, as charted by banks and a plethora of private corporations tied to government, cannot be viewed in isolation from the broader societal, philosophical, and ethical tapestry it weaves into. While the allure of convenience and modernity is undeniable, the journey must be undertaken with utmost prudence, ensuring that the sacrosanct rights of individuals aren’t relegated to mere footnotes in this digital saga where it becomes a battle of access to justice which is dominated by those with financial resources. Remember that old saying – cash is King!

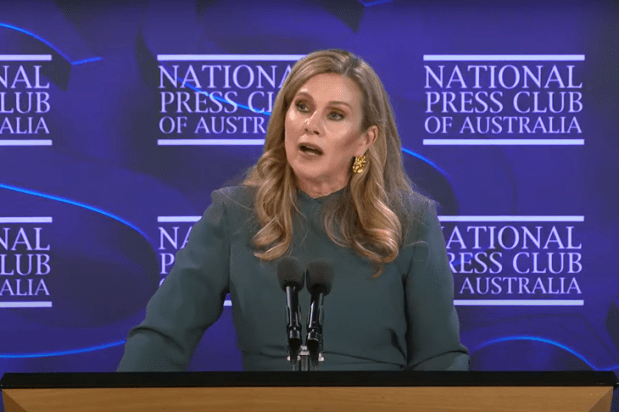

Tony Nikolic – Ashley, Francina, Leonard & Associates