The basic question to ask about the collapse of the $200 billion Silicon Valley Bank (SVB) is, why did it take so long for such a collapse to occur?

The root cause of the bankruptcy is the vast increase in US government spending, which, like that of other governments, was not accompanied by matching increases in taxation. Inevitably, the outcome of that is an increasing money supply monetary policy. And the corollary of that will always be an increase in inflation.

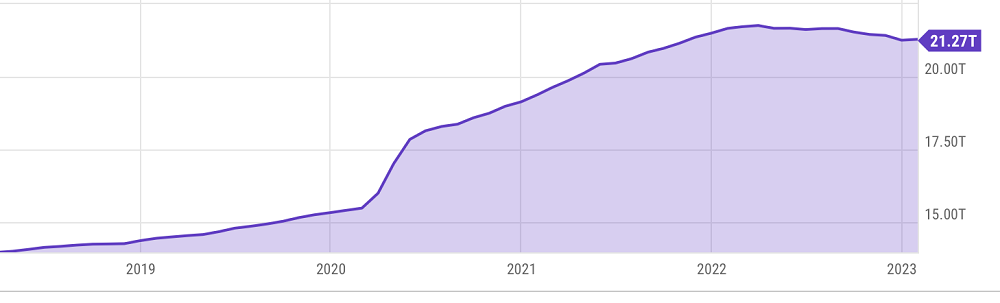

When the US Federal Reserve started to combat the excessive supply of money it did so by the only way available – buying up debt – mainly government Treasury bills – and retiring those bills. As the chart below shows, such action commenced early in 2022.

SVB was the favoured depository for tech entrepreneurs to park the funds tech lenders had supplied them and to draw down these funds for rent, salaries etc as needed. Ostensibly, the firm made a big mistake. It invested the funds it had on call to depositors in long-term bonds without hedging those investments against falls in their value that would accompany increased interest rates.

As such an outcome is inevitable, apparent incompetency by SVB management is left on show. This may not be unrelated to the bank promoting its ‘inclusive’ board, which comprised 45 per cent female, 1 black, 1 LGBTQ+, and 2 veterans while the Daily Mail ran a recent article with the headline: Go woke go broke! SVB hired board obsessed with diversity, invested $5BN for ‘healthier planet’ and held month-long Pride celebration – but had NO chief risk officer for eight months last year.

Presidential candidate, former merchant banker Vivek Ramaswamy, notes there may be deeper reasons. SVB was at the pointy end of bank Wokeness, advertising about how it was lending to ensure the less advantaged were given a leg-up and to ‘support a healthier more sustainable planet’. Was SVB even more focused on Woke lending criteria than other banks? It certainly promoted itself as a leader in loans to renewable energy and perhaps as a result was the favoured bank of the tech industry.

But ‘responsible’ Woke lending is at the heart of the Environment, Social, Governance (ESG) goals that US Treasury Secretary Janet Yellen – the most senior official involved in financial oversight – has been urging all banks to follow. Indeed, Yellen is sponsoring legislation that will make it difficult for any bank to avoid increased emphasises on ESG.

It may therefore be no coincidence that, in seeking to arrest a more general meltdown of the banking system, Yellen was very quick to ensure that the 93 per cent of deposits that were not automatically protected from loss (because they were less than $250,000) would be so protected. This, she implausibly claimed, would be at no cost to the American taxpayer.

Though there are particular reasons for the failure of SVB (and another institution, Signature Bank) the fact is that when governments flood the economy with money this creates imbalances and distorts the value of different assets. Unwinding this creates weaknesses.

Australian banks seldom venture heavily away from housing financed by floating interest rates in their loan portfolios and the Australian Prudential Regulation Authority has tighter supervision over hedging risk. A crisis that mirrors that in the US is therefore unlikely.

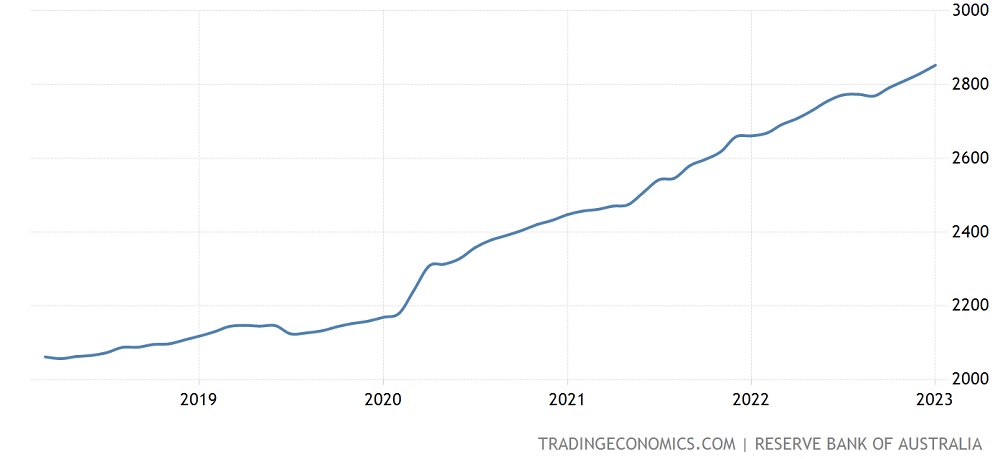

Even so, Australian monetary growth has been rapid and in spite of 10 rate hikes since May 2022, excessive liquidity has not been tamed and the interest rate at 3.6 per cent set at the Reserve Bank’s March meeting remains below the inflation rate.

Australian Increase in Money Supply (M3)

The reaction of the Australian stock exchange, like Wall Street, indicates a level of concern about some banks as well as regarding the economy generally. The US crisis coming out of the blue is a reminder that correcting imbalances caused by excessive liquidity is not easy. Weak spots in the financial system that are revealed in the unwinding process are not easy to recognise. They are usually only exposed, like bankruptcy itself: slowly at first then rapidly.