Financial Services Minister Stephen Jones recently foreshadowed that the Albanese government will propose curtailing aspects of the superannuation tax concessions. Unsurprisingly, the debate that’s followed has focused on the merits of the tentative proposals. However, it’s possible to infer from a close examination of Jones’ comments that such debate is a distraction from his true intent.

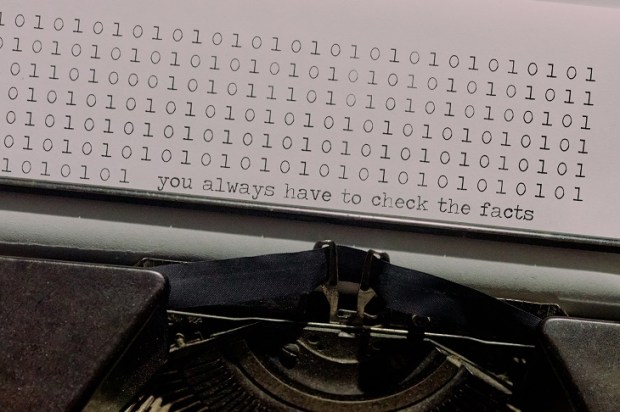

As an aside, it’s worth keeping in mind that whatever Jones’ says should be examined sceptically (more than other politicians, anyway). This is because he’s already shown his true colours by trying to wind back the superannuation disclosure laws under the pretence of reducing unnecessary compliance. This was despite his own Treasury department saying that the effect of the disclosure laws was so unburdensome on superannuation trustees that producing a regulatory impact statement was unnecessary.

Jones sought to bind the superannuation tax concession curtailments with legislating an objective for superannuation, saying that the latter was a pre-condition of the former. But there’s no apparent genuine and logical reason for why this is so. Even if the superannuation tax concessions were wound back absolutely, super’s underlying accepted purpose, that is, to provide for retirement in lieu of a pension, wouldn’t change.

The only place where the two matters even remotely intersect is if the rates of tax inside super are higher than outside, such that superannuation’s purpose was instead to impose taxation by stealth. But the government is simply proposing to reduce the tax concessions, not reduce them and impose new taxes. Thus, there must be another reason for why Jones is trying to link the two matters.

It could simply be that the Overton window is open, so Jones is trying to get as much superannuation-related legislation through it as possible before it closes. But if that were so, it doesn’t explain why Jones talks about the two matters in inseparable terms. As such, it’s probable that there’s more to it than meets the eye.

Alternatively, it could be to add another reason to support the Albanese government’s intention to introduce a legislative objective of superannuation that allows the government to use peoples’ superannuation to fund social causes. However, it’s likely that any law permitting this won’t easily pass the Senate where Labor lacks a majority. Even with the support of the Greens, Labor will need the vote of at least one crossbencher, presuming the Coalition don’t support the government. But the crossbenchers are no rubber stamp, as proven with Labor’s Secure Jobs, Better Pay Bill.

But what if, by merging the two matters, the Albanese government can bypass the Senate in introducing their objective of superannuation? Under section 53 of the Australian Constitution, the Senate lacks the power to amend proposed laws imposing taxation or appropriating revenue. To prevent the Senate from being deceitfully bypassed, section 55 prohibits the government from ‘tacking’. That is, to include matters in a tax bill that don’t deal with taxation.

Ordinarily, that means that the two proposed changes (superannuation tax concessions and the legislated objective of superannuation) would have to be introduced in separate bills, with only the latter requiring senate approval. Herein lies Jones’ possible ulterior motive. What if the proposed changes to the tax concessions are being introduced not as an end in themselves, but as a means to avoid a legislated objective of superannuation going through the Senate?

In other words, if Jones inextricably links the changes to the superannuation tax concessions with a legislated objective of superannuation, then they can be introduced in the same bill without infringing the tacking prohibition in section 55. And as that hypothetical bill deals with taxation, it would bypass the Senate under section 53. Accordingly, Labor will be able to legislate their objective of superannuation without Senate interference.

Sure, this is speculative. It may also be too generous in presuming that the Albanese government possesses the foresight and the ingenuity to devise such a plan. Nevertheless, it explains why Jones is trying to portray two otherwise different matters as inseparable.

If all this comes to pass, then it’s likely that the Senate will legally challenge the merging of the bills. Even if they’re unsuccessful, the government will have plainly committed a moral wrong by employing subterfuge. In this event, it will be difficult for Anthony Albanese to maintain he hasn’t broken his election pledge to ‘change the way that politics operates in this country’.