Upon the election of the Albanese government in May 2022, Commonwealth gross debt stood at $888 billion. Today, it has ballooned to $951 billion, an increase of $63 billion in less than three years.

This increase comes despite the Albanese government benefiting from record tax revenues, driven by bracket creep, historically low unemployment, and external events fuelling commodity export revenues. Treasurer Jim Chalmers has even boasted of delivering two budget surpluses, a rare feat in recent Australian fiscal history. So how, in the face of such budget surpluses and unprecedented revenue windfalls, has the nation’s debt continued to soar?

The answer lies in the government’s deceptive accounting tactics, which obscure record levels of spending both on-budget and off-budget. This financial sleight of hand conceals the true extent of Australia’s deteriorating fiscal position and allows the government to continue its reckless expenditure while claiming fiscal responsibility.

The dire state of Australia’s public finances and high levels of debt are not solely the fault of the current government. This crisis has been brewing for over two decades under successive administrations. However, the upcoming Commonwealth budget, scheduled for 25 March 2025, may serve as the final damning piece of evidence that the Albanese government is the most fiscally reckless in Australian history, surpassing even the Whitlam and Morrison governments.

Beyond the already significant debts racked up by state and territory governments, the Commonwealth’s gross debt is now teetering on the edge of an eye-watering $1 trillion, approximately $37,000 per person. This enormous burden is not just a problem for today, but it will weigh down future generations, who will be forced to shoulder the costs of servicing this debt while also grappling with the demographic time bomb of an ageing population.

Signs of economic decline are already stark. According to analysis by MacroBusiness, Australia has suffered an 8.4 per cent decline in real per capita household income, a figure that dwarfs the 3.6 per cent decline experienced during the recession of the early 1990s. Meanwhile, the OECD has reported that Australia’s household income decline is the worst among all developed nations. If Treasurer Chalmers’ ‘soft landing’ feels like this, one can only imagine the devastation of a ‘hard landing’.

Yet, rather than change course, the government presses on with its spending spree. According to analysis by the Australian Financial Review, the Albanese government has committed to at least $124 billion in discretionary spending decisions over just three budgets. These include expanded subsidies for childcare, aged care, health, housing, and green energy. With additional budgetary sweeteners and off-budget commitments on the horizon, Australians can expect a decade of deficits and increasing hardship.

A striking example of wasteful spending is the government’s ongoing financial support for the National Broadband Network. A fresh $3 billion bailout has been announced, supported by the Coalition, adding to the staggering $31 billion already funnelled into this government-owned entity, which has accumulated lifetime losses of $35.6 billion essentially wiping out every taxpayer dollar invested. Worse still, with the Commonwealth’s borrowing rate currently at 4.3 per cent, Australian taxpayers are now shelling out an additional $1.5 billion per year in interest costs alone for this failed venture.

But the spending spree doesn’t end there. Expected allocations for Cyclone Alfred clean-up and remediation, private health insurance rebates, increased defence spending, and further energy bill relief will only add to the fiscal burden. And then there’s the $11 billion for public servant pay increases that somehow didn’t make it into prior accounting.

Perhaps the most absurd example of the government’s economic incompetence is its energy bill relief policy, a scheme that belongs in an episode of Yes, Minister. The government first implements policies that deliberately increase the cost of energy, and then, after achieving its goal of higher prices, rolls out subsidies to ‘relieve’ consumers from the very costs it created. This is bureaucracy at its most farcical.

The National Disability Insurance Scheme (NDIS) remains an ever-expanding black hole, consuming more and more taxpayer resources while incentivising disability diagnoses. Already costing $50 billion per year, it is rapidly becoming the dominant force in Australia’s labour market. According to Treasury officials, 83 per cent of jobs created last year were in the ‘non-market’ sector comprising public servants and government-subsidised care economy workers such as NDIS workers. Without fundamental reform, any suggestion that NDIS spending will be contained should be dismissed outright.

Currently, 680,000 Australians are enrolled in the NDIS, with 52 per cent under the age of 18. Yet, in what can only be seen as an open invitation for even more enrolment, newly sworn-in NDIS Minister Amanda Rishworth has publicly claimed that there are 5.5 million disabled Australians, 20 per cent of the population.

On current trajectory, budget deficits will stretch as far as the eye can see, and the 2026 budget will be more than just a sea of red. It will be a fiscal bloodbath.

Meanwhile, rather than crafting a policy platform to address Australia’s deteriorating economy and intergenerational financial theft, the Coalition is busy engaging in trivial political squabbles. Their latest distraction is complaining about President Donald Trump’s tariffs and Australia’s lack of exemptions, as if there was ever a serious chance of receiving special treatment.

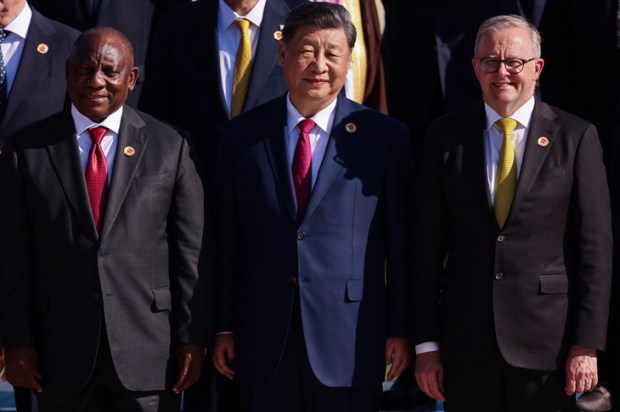

The reality is that Trump has granted exemptions to no nation. Not Canada, not the United Kingdom, and certainly not Australia. The idea that Peter Dutton could have succeeded where Anthony Albanese failed is political theatre at best. Canada’s relationship with the US is akin to New Zealand’s relationship with Australia. Jokes may be made at each other’s expense, but when it matters, they are family. America may like Australia, but we are no Canada.

The bottom line is that the Albanese government’s fiscal irresponsibility has set Australia on a dangerous path of rising debt, economic stagnation, and intergenerational hardship due to unchecked government spending and financial mismanagement.

Unless drastic measures are taken to rein in spending, implement meaningful economic reform, and restore fiscal discipline, Australia will be saddled with mounting debt and declining prosperity for decades to come. Future generations will pay the price for today’s political short-sightedness, forced to bear the consequences of a government that refuses to live within its means. The coming years will not just be marked by economic challenge but by a stark reckoning with the cost of fiscal irresponsibility.

Got something to add? Join the discussion and comment below.

You might disagree with half of it, but you’ll enjoy reading all of it. Try your first month for free, then just $2 a week for the remainder of your first year.