The recently deceased Charlie Munger of Berkshire Hathaway was arguably the most successful investor ever. He was noted for his pithy statements, one of which was, ‘Invest in a business any fool can run, because someday a fool will.’ Under his and Warren Buffett’s management, the fund adopts the standard portfolio investment theory of investing in all sectors but targeting firms with great management systems. The sectors in which Berkshire Hathaway invests include food, technology, retail, home building, motor vehicles (only EVs), traders, telecoms, and energy (both oil/gas and renewables). Warren Buffett said about the latter, ‘We get a tax credit if we build a lot of wind farms … that’s the only reason to build them.’

Many other investment funds do not follow this approach. Of the 42 Australian superannuation funds having over five years of data listed by Canstar, half identify as having major self-imposed environmental-based restraints on investing in hydrocarbon energy suppliers. These superannuation funds include almost all that are headed by union-friendly ALP luminaries. Several funds make such investments and then seek changes in the firms’ management strategy and sometimes their management itself.

A recent high-profile example of activism in action was the pressure on gas producer Woodside, which has a stock value of $63 billion. Some activist fund managers sought (unsuccessfully) to remove the firm’s Chairman who has senior responsibility for its management. Others sought to force the firm to change its investment and management expenditures in order to reduce its emissions of CO2 and those of its suppliers and customers.

Although the activists failed in their main aims, indeed, the firm has announced $18 billion in new gas and oil ventures, Woodside advised that $5 billion had been earmarked for green investments. Though little of this has actually been spent, its statement is, nonetheless, a bow before the Net Zero altar. As Woodside’s rival global gas firms are retreating from Net Zero, this indicates that the pressures the firm faces have had some effect. At the very least, Woke investor pressures may have diverted executive resources from directions the firm’s management would have preferred.

According to Canstar data, over the past five years, in aggregate, the funds that purport to discriminate against businesses involved in fossil fuels have performed similarly to those having no such policies. Among those leading the charge against Woodside’s emissions policy were several overseas funds as well as Australian industry funds, including Hesta, AustralianSuper, and Aware. These three firms have performed above average and although the small print always says, ‘past performance does not necessarily equate to future results’, this may have given them the confidence to take their highly public activist stand.

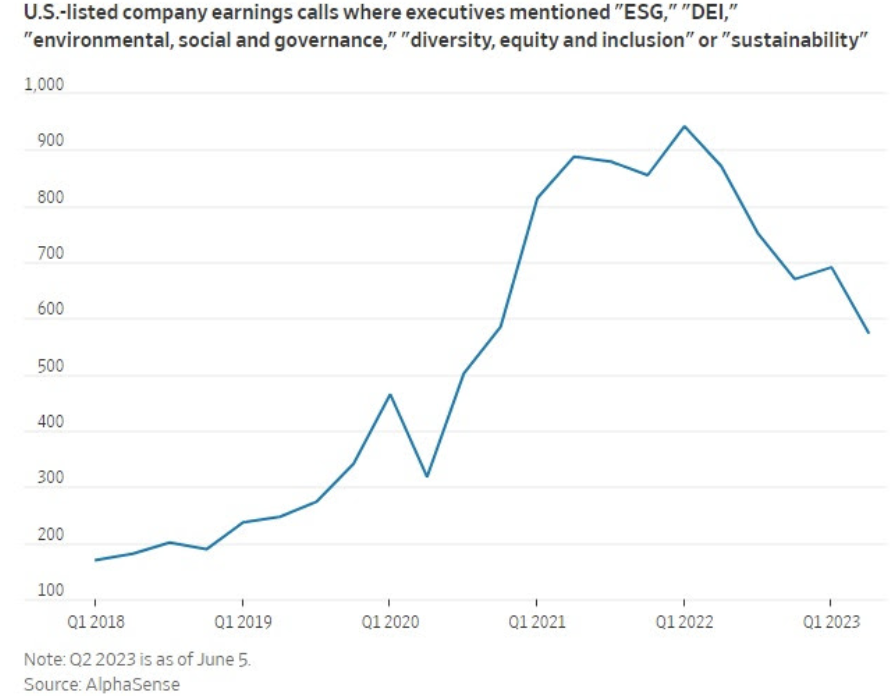

There are some indications that fund manager Wokeness is in decline. US listed companies have fewer mentions of the key acronyms (ESG and DEI) in recent years.

This may be because using the trigger words forces them to provide evidence that will be scrutinised in view of ‘greenwashing’ accusations. It might also be due to some US States pushing back against financiers discriminating against coal and oil.

As in the US, in Australia, superannuation funds have immense influence on company share prices and hence the ownership and management. They control $3.4 trillion in assets, equivalent to the total capitalisation of firms listed on the Australian Stock Exchange.

Fund managers’ area of expertise is picking the firms with the best managers and prospects, not in actually running the businesses. Traditionally, fund managers reacted to poor performance by selling the stock. Where they seek to modify the behaviour of the firms in which they invest, they are stepping outside their skill sets.

Early shareholder-activist fund managers avoided stocks which involved arms production, alcohol, etc. but they did so at the behest of their investors, recognising that this would likely reduce returns somewhat.

Some modern fund managers, in going much further, may claim that they are forcing a modification of their targeted firms’ activities on behalf of their members – protecting them from adverse long-term damage from climate change. The merits of this are contested and, in any case, such the policies are not always fully disclosed and are seldom heralded as the key strategic criteria that they have often become.

Moreover, if one group of investors forces a business to modify its strategy, this also impacts the other shareholders. If the outcome is a reduced performance, then other shareholders share the adverse effects.

These issues appear to be troubling the biggest fund manager BlackRock, a leader in activist fund management. Possibly because its Woke approach to oil and gas has brought recriminations from some US state governments. BlackRock is trialling a ‘Voter Choice’ policy that offers the ability of its individual investors to apply their preferred voting policy to the companies that BlackRock owns.

Whether or not this has any legs, the Albanese government would not move to reaffirm the goal of fund management focusing exclusively on maximising the members’ wealth. Indeed, the Prime Minister envisages a great role for superannuation funds to take a larger part in ‘big national priorities’ that would clearly include the Net Zero agenda. It has appointed a climate warrior, former Minister Greg Combet, the outgoing head of the ‘Net Zero Economy Agency’ as the head of the Future Fund; this was established to ensure public service superannuation is fully funded. The message offered by Mr Combet’s appointment is that the government is encouraging superannuation funds to operate in ways that further its goals to replace coal with wind and solar and to facilitate these energy sources supply capabilities by financing the transmission and batteries that they need.

All this suggests concerned investors should ensure that they share the views of those they entrust to manage their funds.