A year ago, Liz Truss and Kwasi Kwarteng had just announced that they would hold a mini-Budget. It turned out to be the tax-cutting Budget that people like me had long been arguing for. So why wasn’t I more supportive at time, and since? I look at this in my Daily Telegraph column and it takes us to a debate we have quite often at The Spectator’s offices: where Truss got it right and where she didn’t.

During the Tory leadership campaign my sympathies were more with Truss and her tax-cutting growth message. James Forsyth was leaning a bit more towards Sunak and Kate Andrews was asking why Truss’s numbers didn’t add up. Kate and I debated the Truss legacy on a podcast and we’ve been rekindling that debate in the office in recent days.

Here’s how I saw it: Truss was using the language of tax cuts but the cuts she proposed were quite mild – nowhere near enough to kick-start the 2.5 per cent growth she spoke about. I agreed with her that, in theory, some tax cuts would pay for themselves by generating more growth. I agreed with her that markets would probably lend for this purpose. Kwasi Kwarteng, as chancellor, pointed out that if the market would lend £400 billion to close down an economy in Covid then it would lend for economic rejuvenation.

So in theory, Truss and Kwarteng were correct. In practise, the following points sank them:

• The Truss team never explained how much growth they expected in return for their tax cuts. This made it look as if even they had no plan, just verbiage.

• The Truss tax cuts, when they eventually came, would have added up to about £25 billion on £1,100 billion of government receipts (in 2026-27). So even if she had stayed, the UK would still have been struggling under the highest tax burden for 70-odd years that Truss rightly complained about. At The Spectator, we calculated that her mini-Budget meant taxes would actually keep rising, albeit not by not as much.

• The market mood had turned: by September 2022 it was obvious that Kate Andrew’s much-derided warnings about inflation were right and rates had started to rise just as she foresaw. The era of cheap money was over.

• Then there was the hidden pensions crisis: a staggering £500 billion in peculiar investment vehicles (LDIs) sensitive to the large interest rate rises now underway. But no one saw it coming. Incompetent regulation had led to a repeat, in Britain, of the subprime mortgage crisis. Truss would have delayed the mini-Budget had she been warned that that this LDI crisis was blowing up and the Bank of England needed to deal with it before any fuel was added to this fire.

• But regulators and financial commentators had all missed this massive bomb under the UK economy so it suited everyone (Sunak, Starmer, analysts and financial pundits) to blame it all on Truss.

But the centrepiece of her economic plan was a massive, open-ended commitment to subsidise fuel bills. How much would it cost? She had asked the OBR not to score her mini-Budget so there was no real answer. The only figures published were those from the Treasury figures looking at just six months of the scheme: £60 billion, they said (table 4.1 of mini-Budget). Scarier than earlier IFS estimates at £60 billion for one year and £100 billion for two years. Cornwall Insight had the same range.

By comparison, Sunak’s furlough – then the most expensive scheme in the history of British government – had cost £69 billion. So it looked like Truss was to top that quite easily and embark upon the biggest borrow-and-spend attempted by any government, Labour or Tory. Her tax cuts would dwarf in comparison to her splurge. One part Reagan to four parts Chávez.

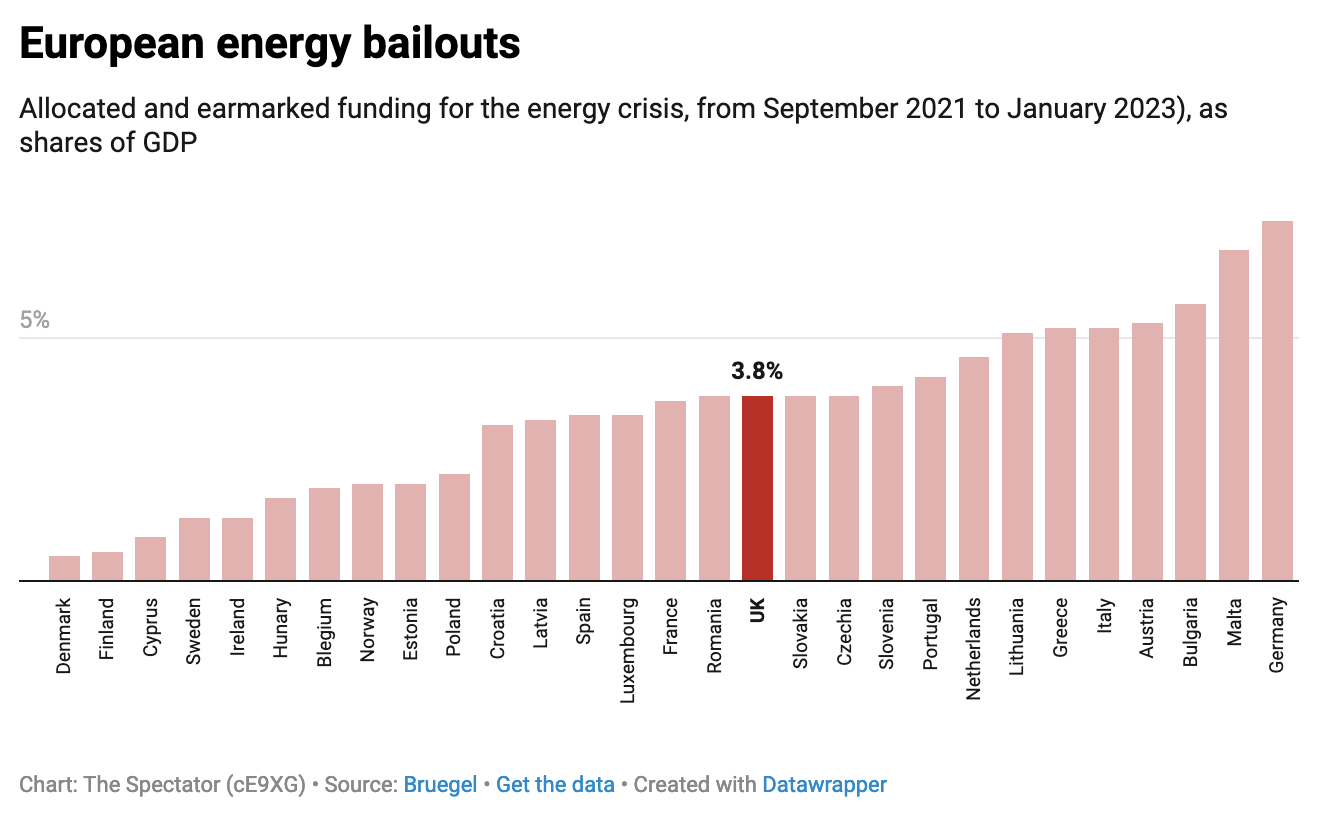

Truss argued that there was no time to come up with anything cheaper or more open-ended than her bailout. In her defence, her energy package ended up costing far less (about £30 billion) because energy prices fell faster than expected. The UK’s energy bailout was about middle of the European pack.

So Truss is right to say her splurge ended up costing almost half much as the IFS (and, in November last year, the OBR) feared. But absolutely no one predicted that at the time: her own Treasury very much included. Futures markets had very clear and quite terrifying view on coming fuel costs. So after the shock-and-awe of her mini-Budget it would have seemed to the markets like Truss was embarking on Britain’s biggest ever borrow-and-spend package, without offering any visibility on how much it was likely to cost. This spooked them.

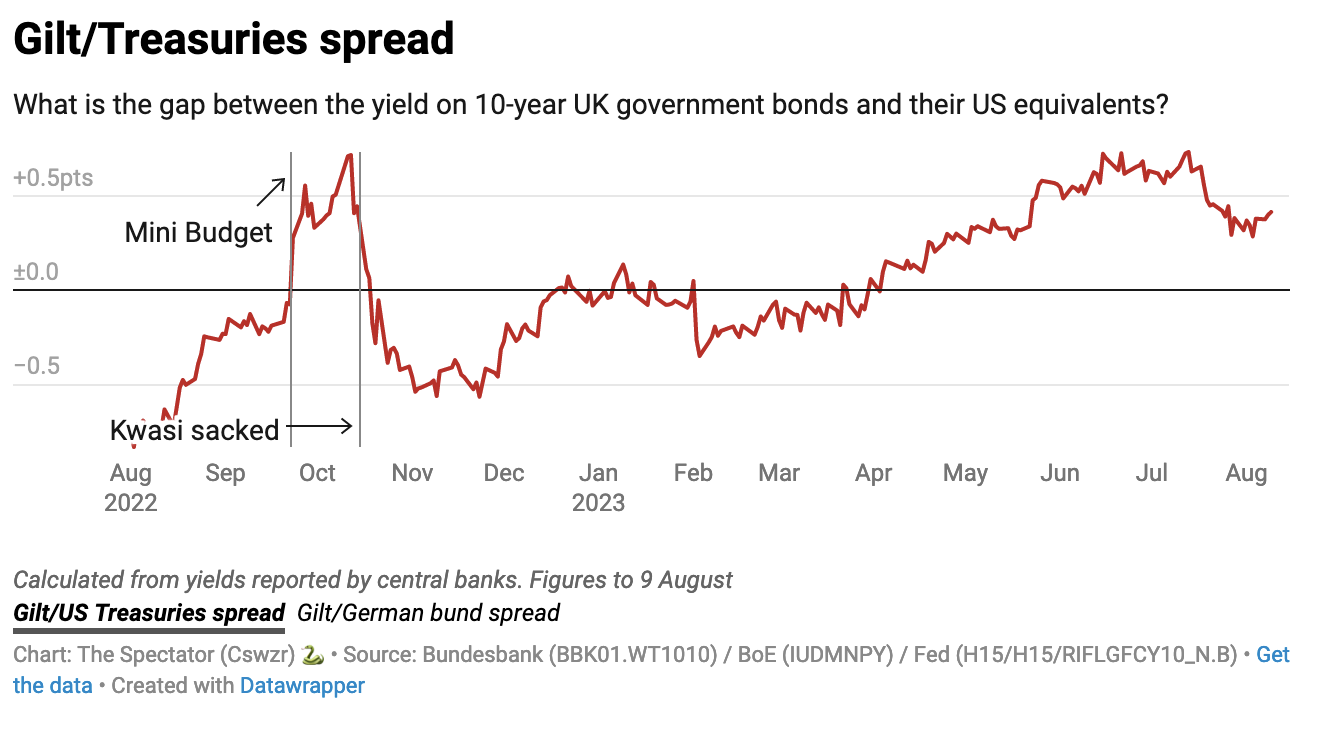

Being tapped for staggering sums against a backdrop of unprecedented rate rises, the markets simply refused. UK gilt yields shot up. And while everyone’s gilt yields had shot up, ours were higher. Everyone was blaming Truss for all of it so at The Spectator data hub we tried to quantify this by comparing UK gilts to those of the US. At the time, I unkindly called a ‘muppet premium’, saying the premium to the US rates was punishment for the UK being muppets.

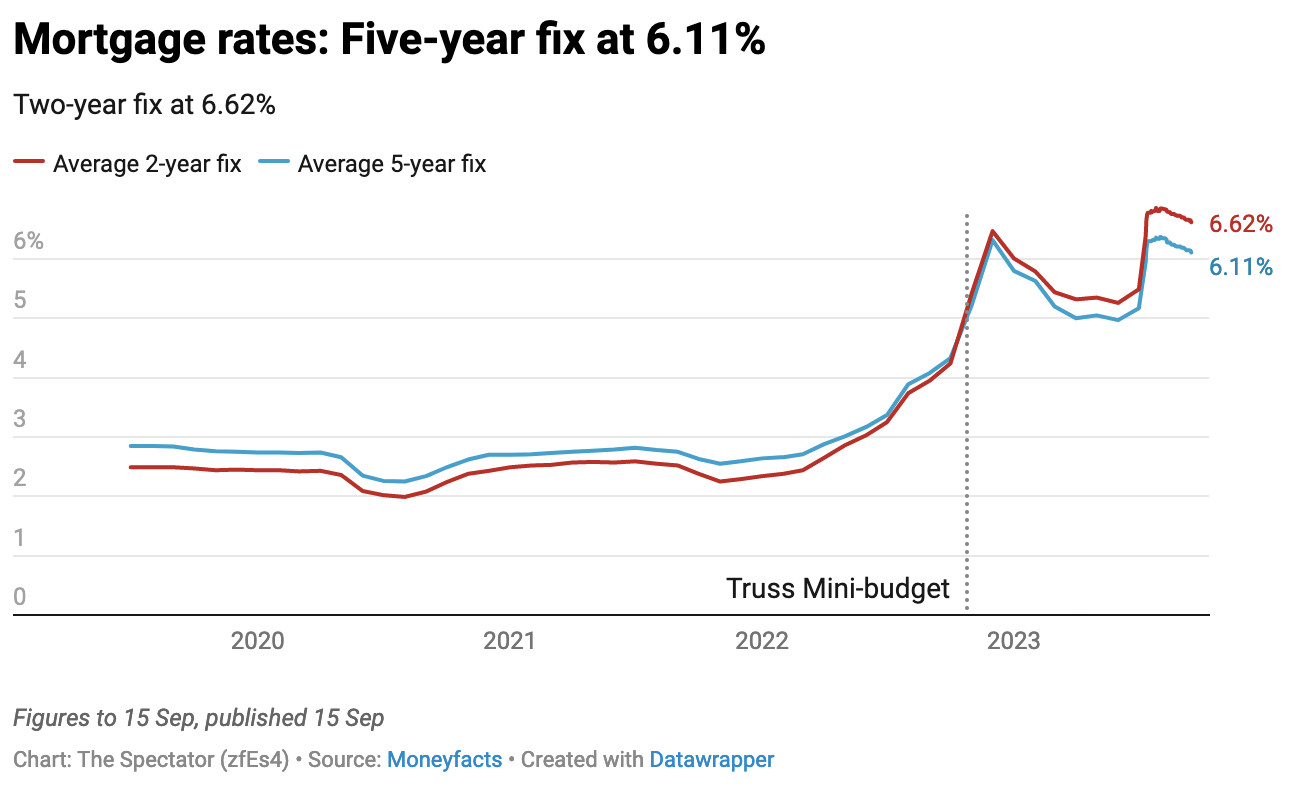

But that muppet premium has come back, thereby destroying the theory that Sunak, with his huge corporation tax rises, would make mortgages and loans cheaper because he offered more reassurance. And by the way, look at mortgages: now higher than they were under the mini-Budget. That particular aspect of the Sunak argument has bitten the dust.

What Truss and Kwarteng were shooting for was the JFK argument: that a deficit caused by stagnation was worse than a deficit used to fund tax cuts and fund a transition to higher-growth. While we’re here, let’s quickly quote Kennedy’s 1962 speech to the New York Economic Society:

Surely the lesson of the last decade is that budget deficits are not caused by wild-eyed spenders but by slow economic growth and periodic recessions, and any new recession would break all deficit records. In short, it is a paradoxical truth that tax rates are too high today and tax revenues are too low and the soundest way to raise the revenues in the long run is to cut the rates now.

I agree with that theory, but I don’t think the Sunak and Kwarteng tax cuts would have been enough. The only way space for serious tax cuts would have been created was to seriously reform government spending – but Truss splurged. In a crisis. This is how big government gets bigger: crisis by crisis. Truss could have stemmed this by excluding the rich from fuel bill subsidies: in fact, means-testing them far more than she did. So her proposed extra spend vastly outweighed her proposed tax cuts.

The Tories, I fear, are learning the wrong lessons from Truss by putting her down as a kamikaze tax-cutter. She’d have liked to go down as a free-market martyr but she ended up running a short leg of a relay race of high-spending, big-state Conservatives. Her borrow-and-spend sank her, not her slash-and-cut-tax agenda.