Scandal-hit celebrities Johnny Depp and Martha Stewart have coincidentally – yet decisively – proved my working PR theory (of several years standing) that the consequences of having ‘a bad reputation’ are far from fatal. And this must warm the cockles of any brands caught in the crosshairs of particularly taxing PR disasters or an avoidable crisis of some seven years’ incubation.

Should any rogue corporation need added proof that misdeeds needn’t necessarily root your reputation, all they have to do is think Depp or Stewart. Or they can Google the term ‘PR scandal’ alongside any of the ‘Big Four’ accounting consultancy brand names to find a range of alarming events that didn’t terminally torpedo business operations.

Today, reputation is out but, conversely, redemption is firmly in! Along with the death of reputation goes the 2000+-year-old claim by Publilius Syrus that; ‘A good reputation is more valuable than money’. Sorry Syrus, but notes are way more important these days.

Once paraded through the headlines as an alleged domestic abuser, Johnny Depp has bathed in an emotional and rapturous, seven-minute standing ovation after his new flick Jeanne du Barry opened in Cannes recently, thereby opening a moral ‘Cannes’ of worms. Depp’s fresh industry ovation signalled a PR redemption; a welcome back of sorts.

And while courts argued over the truth between Depp and Heard, the court of public opinion (the court of reputation) seems more populated by Depp devotees than Amber adherents. Despite all the damaging claims and the (literally) soiled laundry of parties being aired in the legal proceedings, Johnny emerged financially victorious from his key libel suit and is back working again to fresh acclaim on French terrain. Depp’s tawdry PR defilement appears to have been only temporary.

Similarly, 81-year old Martha Stewart is being near-universally feted for just becoming the oldest swimsuit model in Sports Illustrated magazine’s history. A Forbes article rhapsodised that ‘…as an octogenarian and grandmother, Stewart remains active and remains an icon for female empowerment.’ An icon of empowerment for who…?

Martha, you may recall, was scandalously convicted, jailed, and probated on, according to Wikipedia, ‘felony charges of conspiracy to obstruct, of obstruction of an agency proceeding, and of making false statements to federal investigators’. Stewart acquired a prison record and a temporarily tarnished reputation that doesn’t seem to have hampered her operating capabilities or commercial prospects one iota.

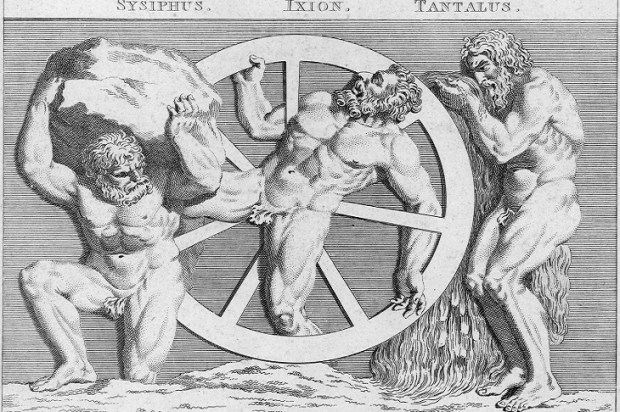

In reality, today’s empowerment icon for reputation rogues is Lazarus of Bethany! You can resurrect your reputation by leveraging some generalised mea culpas, a dollop of high-powered legals, and the odd bit of social media buzz.

So, I wonder again, is the value of ‘a good reputation’ diminished or dead?

Entities like Barclays, United Airlines, Samsung, Volkswagen, and several big footy stars have all endured widely derided PR disasters, and re-emerged from episodes that might have killed careers in earlier times. Another of the ‘big 4’ firms was fined US$100 million by federal regulators. Another still flags a global centre of excellence for corporate crisis and resilience on its website without much irony. By way of disclosure, I have worked alongside several seemingly decent practitioners at PwC on crisis-related simulation work, but not on any tax-related projects.

One key reason for survival from these scandalous scrapes is that the consequences of misadventures are pretty slight: gardening leave while still on the payroll; being de-registered after you’ve made your motzer; a minor moratorium from conducting public sector practice etc. Financial penalties are no penalty for those companies whose business often has a government-endorsed licence to print cash. Even now, some of our quasi-government officials are signalling that measures against unethical operators needn’t be sweeping nor long-term.

Australia’s fairly recent royal commission into banking also debunked Publilius’ pronouncement about reputation by showing that many major finco’s clearly value pelf more than PR: or, in other words, remuneration over reputation. Many of our land’s big bad banking misdeeds featured in Adele Ferguson’s sterling expose, Banking Bad.

Yet, alarmingly, most stakeholders seem apathetic about reputation scandals; there are too few salutary tales about mass stakeholder (or government) defections following financial malpractice infamy. How many virtue-signalling corporations have come out and stated they won’t work with cheating or shonky advisers from this day forward? That said, an unofficial coalition of the Greens and One Nation had already initiated a ministerial inquiry about the work of the big four consulting firms and Labor senator Deborah O’Neill has been outspoken on the most recent episode.

Today, is reputation anything more than an aspirational meme; a re-coloured logo; virtue-signalling on a Linkedin status; tax-deductible fiscal support for a worthy cause, all while those in the big chairs (the money generating seats of power) behave with impropriety away from the public glare or impunity directly in the media’ spotlight of shame?

When any brands, celebrities, or entities become consumed with hubris, greed, and self-interest, they lose the ability to see how their decisions adversely impact other parties. Until society and regulators tackle corporate addiction to the greed, excess, and shamelessness that fuels unethical or immoral practices, these scandals will repeat.

Now everyone deserves a shot at redemption; the notion that something bad can be recovered and restored after it has been remorsefully rectified and fully paid for. Alas, the phenomenon we often witness today is that fees, payments, and windfalls are valued much higher than virtuous actions.

Propriety, public trust, and the value of a good reputation is cheapened for it.